How to Lower Interchange Fees – Revolution Payments

I’m going to explain how to lower interchange fees by including level 2 and level 3 line item detail on your B2B and B2G transactions. This is geared towards businesses that primarily accept credit cards from businesses or government vs. consumer cards. You can implement some of these ideas to help reduce the interchange fees you pay to accept credit cards. When it comes to your money, it makes sense to find ways to keep as much of it as you can.

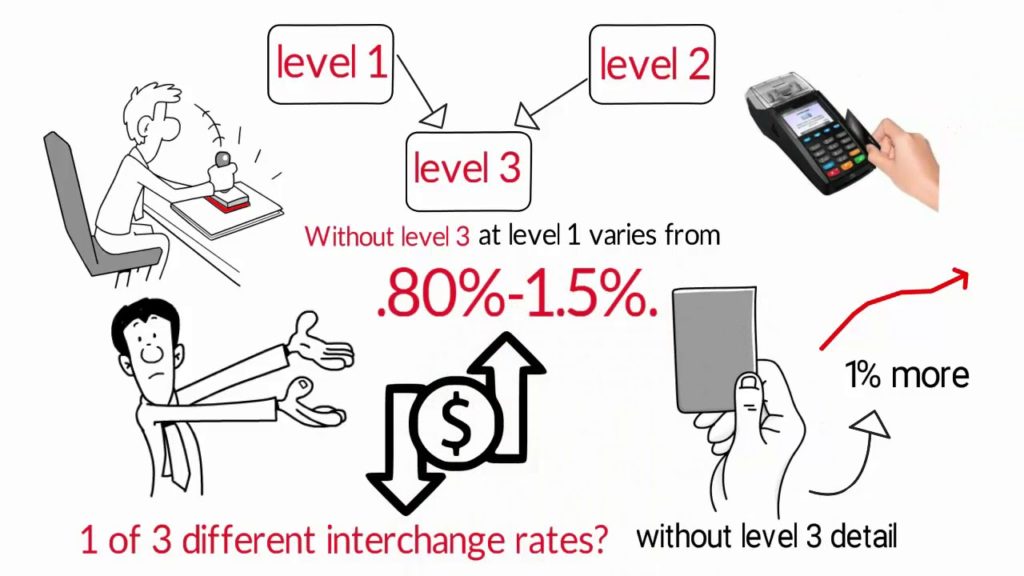

Interchange amounts to at least 80% of the fees you pay to accept credit cards. Not only does interchange go back to the card issuing bank, not your processor, but Visa and MasterCard apply higher interchange rates 80-150 basis points to transactions to commercial and government cards that Do Not include level 2 and level 3 detail. When most people review their rates, they generally only look at a processors rate, even though interchange amounts to bulk of their fees.

Given the current low profit margin derived by processors today the focus should be to better manage the interchange cost and human error cost directly associated with payment acceptance.

Commercial and Government Credit Cards.

Commercial cards have the ability to qualify at lower interchange rates if, level II and level III detail is provided. Commercial cards qualify at 1 of 3 different interchange levels. Level 1, level II or level III. The higher the level, the lower the interchange cost.

Think of level II and level III detail as additional information regarding a sale. Level II, is sales tax and invoice/customer code. Level III is like item detail. Think of information you might find on an invoice.

Visa Level III Requirements

| Discount Amount | Unit of Measure |

| Freight / Shipping Amount | Unit of Cost |

| Duty Amount | Discount Per Line Item and Line Item Total |

| Item Commodity Code | Ship-To Zip Code |

| Item Descriptor | Destination Country |

| Product Code | Ship-From Zip Code |

| Quantity | VAT information (tax amount, rate, invoice #) |

Mastercard Level III Requirements

| Tax Amount | Item Quantity |

| Tax Indicator | Description |

| Customer Code (for Purchasing Cards) | Unit of Measure |

| Tax ID | Extended Item Amount |

| Product Code | Debit or Credit Indicator |

When this information is summitted with a transaction, interchange is lowered by 30%-40%. I will use Visa as an example. Accepting a commercial card without level 3 detail will cost you anywhere from 80 to 150 basis points depending on the type of card and size of the transaction. This happens before your processor ads their fee.

Learn how to lower credit card processing interchange fees by reaching out to your processor to set up your merchant account to process level III processing information You will need to use a level III capable gateway. Terminals do not support level III information however, there are some companies like revolution payments who provide an optimization service that runs behind the scenes and can automatically attach this information before transactions settle.

If you have questions about level III processing or how to lower credit card processing interchange fees. Give us a call at 888 790 3450 or email info@ revolution-payments.com