Level I, Level II, and Level III Credit Card Processing

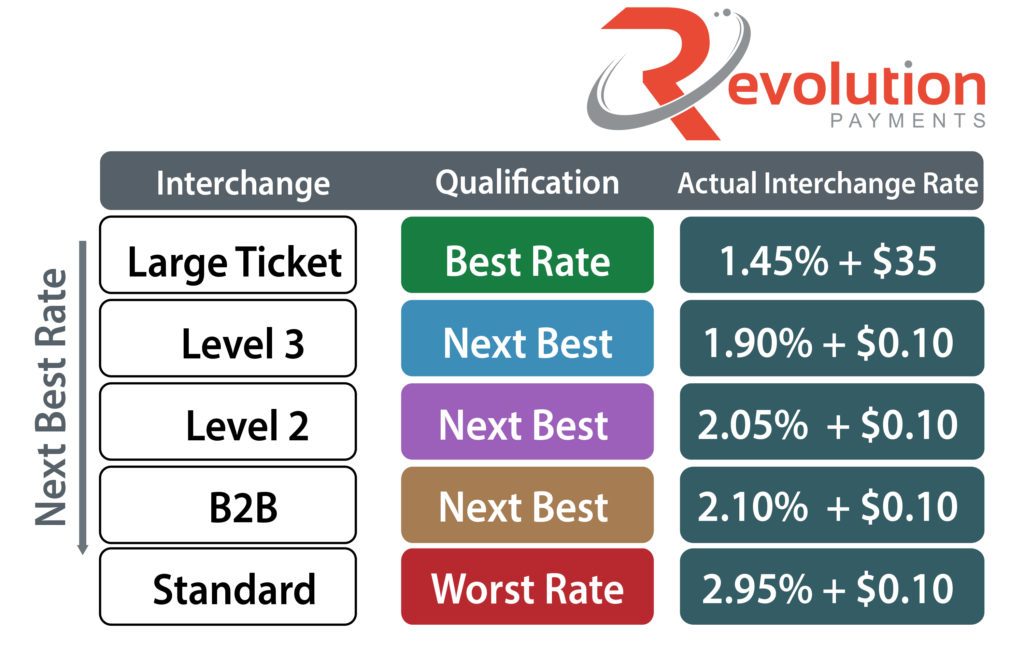

Level I, Level II, and Level III Credit Card Processing defines the different interchange classifications for Business-2-Business and Business-2-Government credit card transactions.

Level III credit card processing is a more detailed way of accepting B2B and B2G transactions. Businesses whos merchants accounts are properly set up can lower the interchange costs of accepting these cards by 30%-40% before your process tacks on their rate.

Interchange is the same for all processors and Level 1, Level II and Level III however when it comes to B2B and B2G transactions interchange will fall into one of four different interchange classifications. The higher the level, the lower the interchange rate.

-

Level 1

- Level 2

- Level 3

- Large Ticket

Level I Credit Card Processing

Level I processing usually refers to transactions that are done between businesses and consumers and includes basic payment details with the least amount of information. That being said, they can also be B2B and B2G transactions. When you process a commercial card without level 3 payment information it automatically clears at level 1, costing you significantly more.

-

Merchant Name

- Transaction Amount

- Transaction Date

Level II Credit Card Processing

Level II processing information is similar to level I but has some additional detail. Level III eligible transactions can/will clear at level II if there are some level 3 requirements missing. Level II interchange lowers your interchange cost by about .50%

Rember, tax exempt transactions are not eligible for the level II savings. The tax amount must between 0.1% and 30% for MasterCard and 0.1%-22% for Visa

- Merchant Name

- Transaction Amount

- Tax Amount (Between 0.1%- 31% for MC and 0.1-22% for Visa

- Customer Code or PO number

- Transaction Date

- Merchant Zip Code

Level III Credit Card Processing

To receive level III interchange rates a transaction must include level I and level II payment detail with the addition of the fields below.

-

Merchant Name

-

Transaction Amount

- Customer Code

-

Transaction Date

-

Ship From Postal Code

-

Destination Postal Code

-

Order Number

- Invoice Number

-

Freight Amount

-

Line Item Detail of Purchase

To qualify to receive level III interchange rates you need a payment gateway or technology that can support the additional line item requirements. Level III payment detail looks like information you would typically find on an invoice.

In addition to the sending level III detail, your processing will need to set you up with a cost plus merchant account. Otherwise your transactions will not clear at the lowest possible rate. I have seen so many businesses set up for level 3 rates but because their merchant account was not set up properly was not get 100% of the benefits.

Previously credit card terminals did not support level III. This was before Revolution Payments optimization service that can automate level III rates regardless of the payment device, software or ERP.

FYI, if you process authorizations the transaction must be settled within 2 days otherwise it will not qualify for level III interchange

Large Ticket Processing!

Visa Commercial Product Large Ticket

Large ticket interchange rates are a way to save even more on your B2B and B2G credit card transactions. Note: Only transactions that have level III detail included will clear at the high ticket rates. If anything is missing, you will 2.7% to over 3% for the same transaction.

Visa- Purchasing Card-Non GSA / Corporate

transaction greater than or equal to $7,755.56

Visa Purchasing Card-Non GSA Prepaid transaction

greater than or equal to $2,908.00

Visa GSA Purchase Card-Transaction must be greater than $5,557.14.

Industries Not Eligible: Travel and Entertainment – Airlines/Passenger Transport (MCC 3000-3299, 4511), Car Rentals/Auto Rental (MCC 3351-3500, 7512), Hotels/Lodging (MCC 3501-4010,

7011), Passenger Railways (MCC 4112), Cruise Lines (MCC 4411), Travel Agents (MCC 4722) Restaurants (MCC 5812, 5814), High Risk Direct Marketing (MCC 5962, 5966, 5967), and

Truck and Utility Trailer Rentals (MCC 7513).

MasterCard

Transaction amount must be $10,000.00 or

greater.

Industries Not Eligible: Travel and Entertainment – Airlines/Passenger Transport (MCC 3000-3299, 4511), Car Rentals/Auto Rental (MCC 3351-3500, 7512, 7513, 7519), Hotels/Lodging

(MCC 3501-3999, 7011), Passenger Railways (MCC 4112), and Restaurants (MCC 5812).

Have questions about Level I, Level II, and Level III Credit Card Processing then give us a call at 888 790 3450. We are also offering no obligation level III interchange audits. Level III interchange experts for over 15 years.