Payment Processing Fees for Government Contractors

In today’s competitive government contracting landscape, keeping overhead low is more important than ever. Yet, one hidden expense continues to chip away at margins — payment processing fees for government contractors. Many contractors unknowingly pay far more than necessary, especially on Business-to-Business (B2B) and Business-to-Government (B2G) transactions, simply because their payment systems aren’t configured to…

+ Read MoreQuickBooks level 3 credit card processing

Reduce Payment Processing Costs with QuickBooks Level 3 Credit Card Processing If your business accepts corporate, government, purchasing, or commercial credit cards, you could be overpaying by as much as 1.5% per transaction. The key to unlocking lower interchange rates lies in QuickBooks Level 3 processing—a powerful solution that can slash your payment processing costs…

+ Read MoreGovernment Contract

As a government contractor, you’ve dedicated time and effort to secure a government contract. But once you win it, are you set up to accept government purchase cards in the most cost-effective way? Few contractors are aware that Visa and MasterCard offer exclusive rates that can reduce transaction fees by 1%-1.5% for those who meet…

+ Read MoreDo You Accept Government Credit Cards

Do You Accept Government Credit Cards… If not, you are most likely missing opportunities you didn’t even know about. Although commonly referred to as the federal contracting market, it’s more accurately described as the federal purchasing market. Why? Because not everything the government buys requires a formal contract. In fact, the most common purchasing method…

+ Read MoreNeed to accept large ticket credit cards

Maximize Savings on High-Dollar Credit Card Transactions Do you need to accept large ticket credit cards. Unlock significant savings on processing fees for large credit card transactions. With Revolution Payments, you can slash your costs for accepting commercial, purchase, and government cards by up to 40%. Don’t let high transaction values eat into your bottom…

+ Read MoreUnderstanding of Ghost Card Payments

This short blog will give you an understanding of Ghost Card Payments and the benefits and new revenue stream it can provide for your company. Introduction: Ghost cards offer a streamlined approach to company purchasing, facilitating expense tracking by department and earning a percentage of interchange fees. Here’s a comprehensive guide to understand their benefits,…

+ Read MoreUnderstanding and Optimizing Level I, Level II, Level III Credit Card Processing

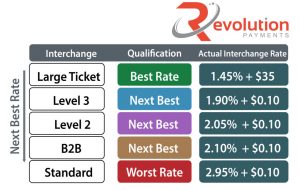

Title: Level I, Level II, and Level III Credit Card Processing play a crucial role in defining interchange categories and qualifications for B2B and B2G credit card transactions. Implementing Level 3 credit card processing can significantly reduce the cost of accepting these transactions by up to 40% before the processor adds their fee. Key Points:…

+ Read MoreLevel I, Level II, and Level III Credit Card Processing

Level I, Level II, and Level III Credit Card Processing defines the different interchange classifications for Business-2-Business and Business-2-Government credit card transactions. Level III credit card processing is a more detailed way of accepting B2B and B2G transactions. Businesses whos merchants accounts are properly set up can lower the interchange costs of accepting these cards…

+ Read MoreSave Money with Level 3 P-Card Processing

If you are a government contractor who accepts credit cards you should familiarize yourself with level 3 credit card processing. Visa and MasterCard created special rates as a way to encourage government government contractors to enter level 3 payment detail. Doing so can lower your cost of accepting these cards by 30%-40%. Make sure you…

+ Read MoreWinning government contracts

If you are like many government contractors you invested a lot of time and energy winning government contracts. Now that you have a contract. How do you accept a government purchase card and keep more of your money. Sean Jones, the president of Revolution Payments explains just that, in this podcast interview. Winning government contracts…

+ Read MoreAbout Us

At Revolution Payment Systems, our entire focus is on delivering reliable and secure payment solutions to help businesses succeed in an increasingly complex global marketplace.

Connect With us

Revolution Payment Systems is a registered ISO of Wells Fargo Bank, N.A., Walnut Creek, CA. American Express requires separate approval.

www.revolution-payments.com Revolution Payment Systems is an Elavon Payments Partner & Registered ISO/MSP of Elavon, GA

© 2016 Revolution Payments | Privacy Policy | Website Developed by Silentblast