Accepting Commercial Cards and Level 3 Processing

I’m going to explain why accepting commercial cards and level 3 processing is SO important. If fact, its so important that accepting a commercial card without it and you lose 1% of revenue that has nothing to do with your processor or your rate.

After 24 years in the payment space and talking with thousands of businesses, I’ve learned the majority of them only look at a processors rate when comparing different processors. Having a low rate is definitely important however, up to 80% of the fees you pay (interchange), has nothing to do with the processors rate. Banks issue credit cards because they earn interchange every time you accept one of their cards.

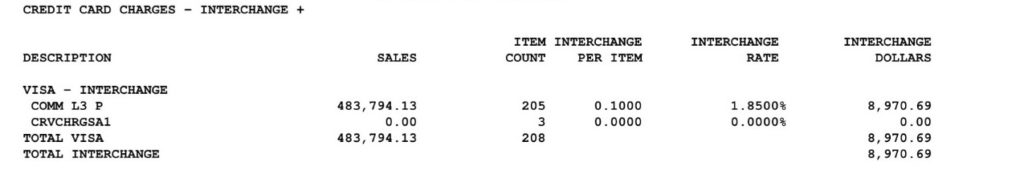

Accepting commercial cards and level 3 processing is so important because, commercial cards have 3 different interchange rates. The cost for accepting a commercial card without level 3 detail cost roughly 1% more in interchange before a processor adds their rate.

The actual rate varies from 80 basis points to 1.5%, depending on the size of ticket and type of card. Accepting commercial cards without level 3 detail, you pay 1% more than the best rate your processor can give you!

What is level 3 processing?

Level 3 Processing refers to passing line-item detail; information you generally find on an invoice; Descriptions, quantities, PO number etc.

Commercial transactions fall into one of three interchange categories; Level 1, 2 and 3, depending on whether level 3 payment detail is included with the transaction. If its not, the transaction clears at level 1 (interchange).

If you accept commercial cards give us a call to find out how Accepting Commercial Cards and Level 3 Processing can have a significant impact on your bottom line revenues.

Questions? Give us a call 888 790 3450