Level-3 processing

Payment Processing Fees for Government Contractors

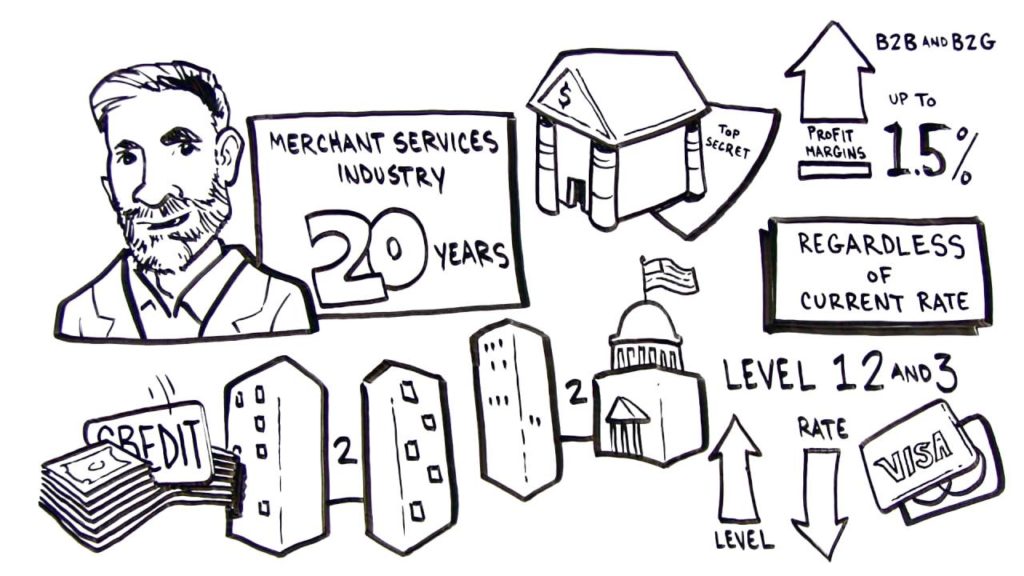

In today’s competitive government contracting landscape, keeping overhead low is more important than ever. Yet, one hidden expense continues to chip away at margins — payment processing fees for government contractors. Many contractors unknowingly pay far more than necessary, especially on Business-to-Business (B2B) and Business-to-Government (B2G) transactions, simply because their payment systems aren’t configured to…

Read MoreQuickBooks level 3 credit card processing

Reduce Payment Processing Costs with QuickBooks Level 3 Credit Card Processing If your business accepts corporate, government, purchasing, or commercial credit cards, you could be overpaying by as much as 1.5% per transaction. The key to unlocking lower interchange rates lies in QuickBooks Level 3 processing—a powerful solution that can slash your payment processing costs…

Read MoreDo You Accept Government Credit Cards

Do You Accept Government Credit Cards… If not, you are most likely missing opportunities you didn’t even know about. Although commonly referred to as the federal contracting market, it’s more accurately described as the federal purchasing market. Why? Because not everything the government buys requires a formal contract. In fact, the most common purchasing method…

Read MoreUnderstanding and Optimizing Level I, Level II, Level III Credit Card Processing

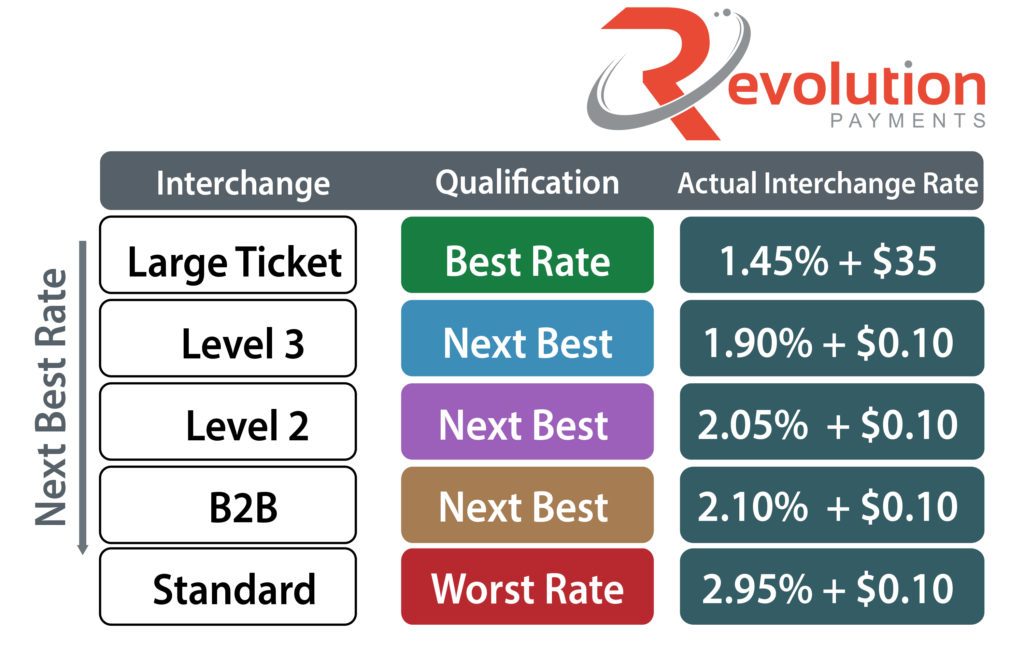

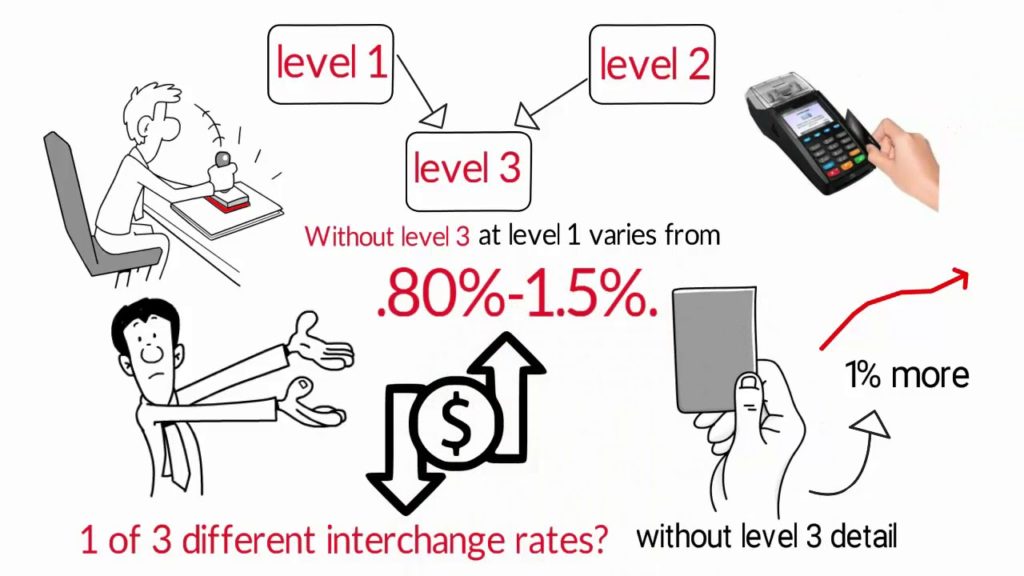

Title: Level I, Level II, and Level III Credit Card Processing play a crucial role in defining interchange categories and qualifications for B2B and B2G credit card transactions. Implementing Level 3 credit card processing can significantly reduce the cost of accepting these transactions by up to 40% before the processor adds their fee. Key Points:…

Read MoreSave Money with Level 3 P-Card Processing

If you are a government contractor who accepts credit cards you should familiarize yourself with level 3 credit card processing. Visa and MasterCard created special rates as a way to encourage government government contractors to enter level 3 payment detail. Doing so can lower your cost of accepting these cards by 30%-40%. Make sure you…

Read MoreWinning government contracts

If you are like many government contractors you invested a lot of time and energy winning government contracts. Now that you have a contract. How do you accept a government purchase card and keep more of your money. Sean Jones, the president of Revolution Payments explains just that, in this podcast interview. Winning government contracts…

Read MoreHow I saved this government contractor over $4,600 per month in fees w/o changing their rate

With the many challenges facing contractors today, many have relied on their banks to set-up their credit card processing. It’s regrettable that many in the contracting industry are unaware of the advantages that correct processing solutions can present. Many years ago MasterCard and Visa have created special interchange rates to support purchase card programs…

Read MoreHow to Lower Interchange Fees – Revolution Payments

I’m going to explain how to lower interchange fees by including level 2 and level 3 line item detail on your B2B and B2G transactions. This is geared towards businesses that primarily accept credit cards from businesses or government vs. consumer cards. You can implement some of these ideas to help reduce the interchange fees you…

Read MoreLevel III Credit Card Processing Solution for Credit Card Terminals

Revolution payments can help your company submit Level III Credit Card Processing Solution for Credit Card Terminals. This is a game changer for businesses who process through credit card machines since terminals do not have the memory capable of sending level III line item detail. With Visa and MasterCard tacking on additional interchange fees that…

Read MoreGovernment contractors Why pay 2.70% vs 1.9%?

Government contractors Why pay 2.70% vs 1.9%? With the many challenges facing contractors today, it’s no wonder that they have relied on their banks to set-up their credit card processing. It’s regrettable that many in the contracting industry are unaware of the advantages that correct processing solutions can present. To support acceptance of corporate &…

Read More