Posts Tagged ‘level 3 processing’

GSA Vendors & Contractors Increase your margins by 1% with level 3 credit card processing

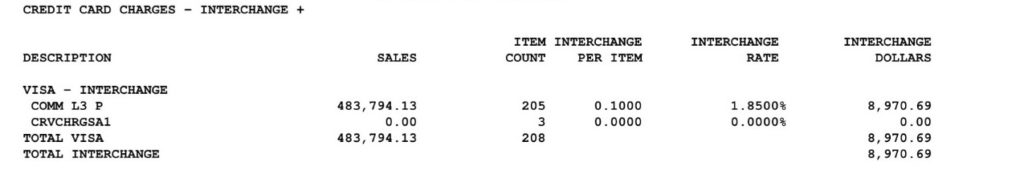

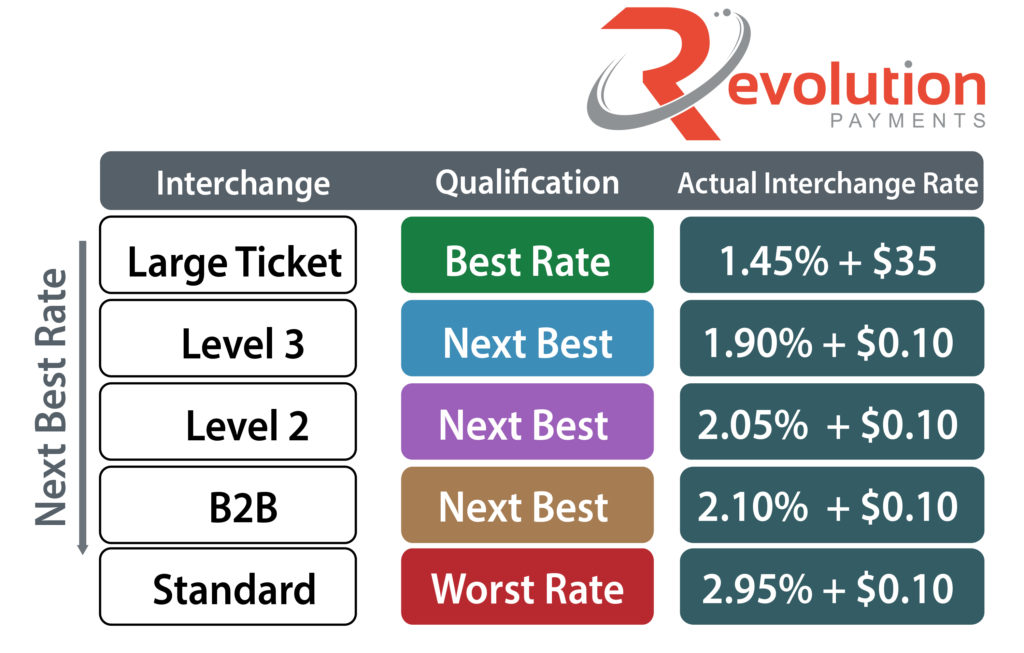

GSA Vendors & Contractors Increase your margins by 1% with level 3 credit card processing! What is Level 3 processing? Level 3 processing is a more sophisticated way of accepting commercial, business, purchase & government cards that allows any business selling to other companies or government to lower transaction cost by 30%-40% from (interchange rebates)…

Read MoreAccepting Commercial Cards and Level 3 Processing

I’m going to explain why accepting commercial cards and level 3 processing is SO important. If fact, its so important that accepting a commercial card without it and you lose 1% of revenue that has nothing to do with your processor or your rate. After 24 years in the payment space and talking with thousands…

Read MoreLevel 3 Processing for Commercial Transactions

Its extremely likely level 3 processing (line item detail) lowers your interchange cost of processing B2B & B2G transactions by 1% or more! Level 3 processing for commercial transactions is a great way to lower interchange cost before processors add their fee. You probably already know this but, whenever you accept a credit card from…

Read MoreHow much can level 3 processing save you?

This post shows how much level 3 processing can save you on your (B2B) business-2-business and (B2G) business-2-government transactions. Even if you have a great rate, accepting b2b, commercial or purchase cards without level 3 detail, you are always going to pay about 1% more than the best rate you can receive from a processor.…

Read MoreGovernment P card processing – Level 3 processing

Government Vendors: Don’t Leave “Rebate” Money on the Table Add up to 1.5% to your bottom line for Accepting Gov & Non Gov Commercial & P-Cards Please note, this is much different than your standard merchant account and will effectively add up 1.5% to your bottom line On ALL Government, Commercial & Business transactions…

Read MoreLevel 3 Credit Card Processing, Is it right for you?

With the many challenges facing contractors today, it’s no wonder so many are relying on their banks or existing credit card processors to set them up to accept Government P-cards. It’s regrettable that many in the contracting industry are unaware of the advantages available for accepting these cards correctly To support acceptance of corporate &…

Read MoreLevel 3 credit cards processing GSA Vendors

Vendors, Did you know Over 15 years ago, MasterCard & Visa created special rates to support Purchase Card programs reducing a vendor’s transaction costs (Interchange) if Level-3 line item detail information is processed with a transaction? Yet, 3 out of 5 vendors are still not set up to participate. By providing Level-3 data, a supplier…

Read MoreLevel 3 Processing | B2B & B2G credit card transactions

Do you accept credit cards from other Businesses or Government? If so, I have some important news that can Add up to 1.5% to your bottom line and Profit margins without having to increase your sales volume…. You probably already know that Visa and MasterCard use “interchange fees” to determine how much you pay an issuing bank each…

Read MoreLevel 3 Payment Processing

Did you know Visa & MasterCard apply “interchange” surcharges of roughly 1.5% for commercial & government credit cards processed w/o level 3 payment detail? If not, don’t worry. Statics show that 3 out of 5 businesses have not been set up to accept B2B and B2G cards properly. It is regrettable that many businesses are…

Read MoreLevel 3 Credit Card Processing-Why you should Consider it!

Why should you consider including level 3 credit card processing if you accept credit cards from other businesses or government? Not doing so, you lose .80%-1.5% of potential revenue on every credit card you accept. To understand level 3 processing if accept B2B Business-2-Business & B2G Business-2-Government transactions you need to have a basic understating…

Read More